History of accountancy

Gallery about the History of accounting

Origins[edit]

Early civilizations[edit]

Accounting is thousands of years old; the earliest accounting records, which date back more than 7,000 years, were found in Mesopotamia amongst the ruins of ancient Babylon, Assyria and Sumeria The people of that time relied on primitive accounting methods to record the growth of crops and herds. Because there is a natural season to farming and herding, it is easy to count and determine if a surplus had been gained after the crops had been harvested or the young animals weaned. Accounting evolved, improving over the years and advancing as business advanced.

-

Clay tokens, from Susa, Uruk period, circa 3500 BC.

-

Economic tablet, Uruk period (3200 BC to 2700 BC)

-

Early writing tablet recording the allocation of beer, Iraq 3100-3000 BC

-

Summary account of silver for the govenor, Iraq 2,500 BCE

-

Issue of barley rations, 2,350 BCE

-

Balance sheet Mesopotamia, 2040 BC (Ur III).

-

Accounting: distribution of food, first half of 2nd millenium BCE

-

Wooden brewery model (Middle Kingdom)... The rightmost figure with a tablet tucked under his arm is a scribe, counting the bottles.

Antiquity[edit]

The Res Gestae Divi Augusti (Latin: "The Deeds of the Divine Augustus") is a remarkable account to the Roman people of the Emperor Augustus' stewardship. It listed and quantified his public expenditure, which encompassed distributions to the people, grants of land or money to army veterans, subsidies to the aerarium (treasury), building of temples, religious offerings, and expenditures on theatrical shows and gladiatorial games. It was not an account of state revenue and expenditure, but was designed to demonstrate Augustus' munificence. The significance of the Res Gestae Divi Augusti from an accounting perspective lies in the fact that it illustrates that the executive authority had access to detailed financial information, covering a period of some forty years, which was still retrievable after the event. The scope of the accounting information at the emperor's disposal suggests that its purpose encompassed planning and decision-making.

-

Account of the construction of Athena Parthenos by Phidias

-

Roman writing tablet

-

Res Gestae

-

Edict on Maximum Prices, 301

Early accounting systems[edit]

The Heroninos Archive is the name given to a huge collection of papyrus documents, mostly letters, but also including a fair number of accounts, which come from Roman Egypt in 3rd century AD. The bulk of the documents relate to the running of a large, private estate is named after Heroninos because he was phrontistes (Koine Greek: manager) of the estate which had a complex and standarised system of accounting which was followed by all its local farm managers.

-

Bill of sale for a donkey

-

John Rylands University Library papyrus collection includes religious, devotional, literary and administrative texts.

Each administrator on each sub-division of the estate drew up his own little accounts, for the day-to-day running of the estate, payment of the workforce, production of crops, the sale of produce, the use of animals, and general expenditure on the staff. This information was then summarized as pieces of papyrus scroll into one big yearly account for each particular sub—division of the estate. Entries were arranged by sector, with cash expenses and gains extrapolated from all the different sectors. Accounts of this kind gave the owner the opportunity to take better economic decisions because the information was purposefully selected and arranged

Medieval[edit]

-

Invoice 1350

Modern history[edit]

Early accounts served mainly to assist the memory of the businessperson and the audience for the account was the proprietor or record keeper alone. Cruder forms of accounting were inadequate for the problems created by a business entity involving multiple investors, so double-entry bookkeeping first emerged in northern Italy in the 14th century, where trading ventures began to require more capital than a single individual was able to invest.

Renaissance[edit]

In the 15th century double-entry bookkeeping was first codified by the Franciscan Friar, Luca Pacioli. In deciding which account has to be debited and which account has to be credited, the golden rules of accounting are used. This is also accomplished using the accounting equation: Equity = Assets − Liabilities. The accounting equation serves as an error detection tool. If at any point the sum of debits for all accounts does not equal the corresponding sum of credits for all accounts, an error has occurred. It follows that the sum of debits and the sum of the credits must be equal in value.

- Documents

-

Ledger, 1477

-

Genua Libro delle Colonne, 1485 (1)

-

Genua Libro delle Colonne, 1485 (2)

- Bookkeeping system by Johann Gottlieb, 1546

Johann Gottlieb was a merchant from Nuremberg, who traded in Venice. He wrote a treatise on double-entry bookkeeping in 1531, and an other book in 1546 both published at Nuremberg. These were the first books on bookkeeping in Germany and popularized the system of double-entry bookkeeping in Northern Europe. In his 1531 book Gottlieb mentions that there are different kinds of businesses and different kinds of systems of bookkeeping, meaning that there are various ways to arrange accounting records (Lee, 1990 p.364)

-

"Jornal oder Teglich Buch/ des ersten Buchhaltens"

Journal -

"Schuldbuch"

Register of debts -

Development of cash position

-

"Guterbuch"

-

"Aus dem folgendem Außzug oder vberkerich"

Closure of accounts -

"Jornal auff Factorey/ des andern Buchhaltens"

Journal -

"Schuldbuch"

Register of debts -

Development of cash position

-

"Guterbuch"

-

"Folgen die uberbleibling"

Closure of accounts

- People on the job

-

Luca Pacioli, 1495

-

1517

-

1529

17th century[edit]

- Documents

-

Ledger, 1683

- People on the job

-

1655

-

The Account Keeper, 1656

-

1698

18th century[edit]

- Documents

-

1726

-

Ledger 1754-55

-

Invoice 1760

-

Invoice 1782

- People on the job

-

1713

-

1718

-

1745

-

1754

-

1756

-

Schreibende Kaufmannsfrau, 1772

-

That accounts for it 1799 caricature

19th century[edit]

The development of joint-stock company created wider audiences for accounts, as investors without firsthand knowledge of their operations relied on accounts to provide the requisite information. This development resulted in a split of accounting systems for internal (i.e. management accounting) and external (i.e. financial accounting) purposes, and subsequently also in accounting and disclosure regulations and a growing need for independent attestation of external accounts by auditors.

Books about bookkeeping[edit]

-

1816

-

1877

Diagrams picturing factory accounting, 1880s-90s[edit]

-

Books and Forms used in connection with Wages, 1889.

-

Books and Forms used in connection with Stores, 1889.

-

Books and Forms used in connection with Prime Cost, 1889.

-

Books and Forms used in connection with Stock, 1889.

-

Diagram of Manufacturing Accounts, 1896.

Documents[edit]

-

General ledger, 1828

-

Watson family slave account entry 1858-05-10

-

Ledger of the fur trader Dedo from Leipzig, 1876-1885

-

Ledger of the fur trader Dedo from Leipzig, 1876-1885

-

19th Century Business Day Book

Invoices[edit]

Invoice forms in the 1870s started to bear fine images of the company's factory, office-building and/or sales facility. An early example of an illustrated invoice is the Adler Rechnung Stephenson 27081835, an invoice from 1833 for the first steam locomotive in Germany, Adler of the Bavarian Ludwig Railway, made out from the locomotive manufacturer Robert Stephenson and Company.

-

1803

-

1803

-

1815

-

1833

-

1840

-

1867

-

1868

-

1870

-

1883

-

1885

-

1887

-

1878

-

1885

-

1889

-

1892

-

1893

-

1893

-

1894

-

1896

-

1897

-

1897

-

1897

-

1898

-

1898

-

1898

-

1899

-

1899

People on the job[edit]

-

1868

-

Chinese accountants at work in their store in San Francisco, 1892

-

BYU Bookkeeping 1895

20th century[edit]

Automation[edit]

-

Old burroughs adding machine, 1890

-

Elliot-Fisher book typewriter, 1903

-

Powers-Samas accounting machine

-

Buchungsautomat Anker BN 800 DZM

-

Accounting machine, 1931

-

Early SSA accounting operations, 1937

-

Electronic Recording Machine, Accounting wiring, 1950s

-

Powers-Samas Cards, 1954

-

IBM 403 Accounting Machine, 1960s

-

IBM 407 accounting machine at US Army, 1961

Diagrams[edit]

-

Prime expenditure divisions of a factory, 1905.

-

Principles of Organization by Production Factors, 1910.

-

Systems of Controlling Accounts, 1910.

Documents[edit]

-

1901

-

1909

-

Ledger, 1910

-

Account book, 1914

-

Cash book, 1921

-

Ledger, 1933

-

1964

Invoices[edit]

- 1900s

-

1900

-

1900

-

1901

-

1901

-

1901

-

1902

-

1903

-

1904

-

1904

-

1905

-

1905

-

1906

-

1906

-

1906

-

1906

-

1906

-

1906

-

1907

-

1908

-

1908

-

1908

-

1908

-

1908

-

1909

-

1909

-

1909

- 1910s

-

1910

-

1910

-

1910

-

1910

-

1911

-

1912

-

1913

-

1913

-

1913

-

1913

-

1913

-

1914

-

1914

-

1915

-

1915 (1)

-

1915 (2)

-

1915

-

1918

-

1919

- 1920s

-

1921

-

1922

-

1922

-

1922

-

1922

-

1923

-

1923

-

1924

-

1927

- 1930s

-

1930

-

1930

-

1932

-

1932

-

1933

-

1934

-

1935

-

1935

-

1935

-

1935

-

1936

-

1936

-

1937

-

1937

-

1938

-

1939

- 1940s

-

1940

-

1943

-

1946

-

1946

-

1946

-

1947

-

1947

-

1948

-

1948

-

1948

-

1948

-

1948

-

1949

-

1949

- 1950s

-

1950

-

1950

-

1951

-

1951

-

1952

-

1956

People on the job[edit]

-

Elmer Candy Co Inc Office New Orleans, 1917

-

Grossman-Weinfeld Millinery Accounting Office NOLA, 1917

-

Hernsheim Cigars Accounting Office NOLA, 1917

-

National Lead NOLA Accounting Office, 1917

-

Southern Pacific RR Misc Accounts Office NOLA, 1917

-

Accounting machine, 1931

-

Early SSA accounting operations, 1937

-

1944

-

IBM 403 Accounting Machine since late 1940s

-

1950

-

1951

-

1952

-

1953

-

1953

-

1953

-

1953

-

1953

-

1953

-

1953

-

1953

-

1953

-

1955

-

1955

-

1955

-

1955

-

1955

-

1956

-

1956

-

1959

-

1960

-

1961

-

1961

-

1962

-

1962

-

1966

-

1973

-

1985

21st century[edit]

Accounting software screenshots[edit]

Accounting software is application software that records and processes accounting transactions within functional modules such as accounts payable, accounts receivable, payroll, and trial balance. It functions as an accounting information system. It may be developed in-house by the company or organization using it, may be purchased from a third party, or may be a combination of a third-party application software package with local modifications. It varies greatly in its complexity and cost.

-

DCFM Calculator

-

Dette

-

Eqonomize

-

Ezersky

-

GnuCash

-

Grisbi

-

Homebank

-

KMyMoney

-

Np5

-

Npss

-

ROSA

Diagrams[edit]

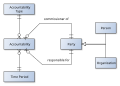

-

Accountability

-

Accountability and Legitimacy

-

Accounting cycle

-

Accounting documents

-

Clinical audit cycle

-

CSR framework - value1

-

GPK Marginal Cost Flow

-

IFAC Definition of MA

-

Material Flow Accounting Scheme

-

Development Managerial Costing

-

MCCF v2

-

MediaWiki database schema

-

Prozessablauf bei Finetrading

-

Accounting information systems

-

Zatrata

References[edit]

This gallery incorporates material from Wikipedia articles on: accounting, accounting software, and double-entry bookkeeping system.

- Thomas Alexander Lee (1990) The Closure of the accounting profession - Volume 1.